Marilyn points out that an income statement will show how profitable Direct Delivery has been during the time interval shown in the statement's heading. This period of time might be a week, a month, three months, five weeks, or a year—Joe can choose whatever time period he deems most useful.

The reporting of profitability involves two things: the amount that was earned (revenues) and the expenses necessary to earn the revenues. As you will see next, the term revenues is not the same as receipts, and the term expenses involves more than just writing a check to pay a bill.

A. Revenues

The main revenues for Direct Delivery are the fees it earns for delivering parcels. Under the accrual basis of acconting (as opposed to the less-preferred cash method of accounting), revenues are recorded when they are earned, not when the company receives the money. Recording revenues when they are earned is the result of one of the basic accounting principles known as the revenue recognition principle.

For example, if Joe delivers 1,000 parcels in December for $4 per delivery, he has technically earned fees totaling $4,000 for that month. He sends invoices to his clients for these fees and his terms require that his clients must pay by January 10. Even though his clients won't be paying Direct Delivery until January 10, the accrual basis of accounting requires that the $4,000 be recorded as December revenues, since that is when the delivery work actually took place. After expenses are matched with these revenues, the income statement for December will show just how profitable the company was in delivering parcels in December.

When Joe receives the $4,000 worth of payment checks from his customers on January 10, he will make an accounting entry to show the money was received. This $4,000 of receipts will not be considered to be January revenues, since the revenues were already reported as revenues in December when they were earned. This $4,000 of receipts will be recorded in January as a reduction in Accounts Receivable. (In December Joe had made an entry to Accounts Receivable and to Sales.)

B. Expenses

B. Expenses

Now Marilyn turns to the second part of the income statement—expenses. The December income statement should show expenses incurred during December regardless of when the company actually paid for the expenses. For example, if Joe hires someone to help him with December deliveries and Joe agrees to pay him $500 on January 3, that $500 expense needs to be shown on the December income statement. The actual date that the $500 is paid out doesn't matter—what matters is when the work was done—when the expense was incurred—and in this case, the work was done in December. The $500 expense is counted as a December expense even though the money will not be paid out until January 3. The recording of expenses with the related revenues is associated with another basic accounting principle known as the matching principle.

Marilyn explains to Joe that showing the $500 of wages expense on the December income statement will result in a matching of the cost of the labor used to deliver the December parcels with the revenues from delivering the December parcels. This matching principle is very important in measuring just how profitable a company was during a given time period.

Marilyn is delighted to see that Joe already has an intuitive grasp of this basic accounting principle. In order to earn revenues in December, the company had to incur some business expenses in December, even if the expenses won't be paid until January. Other expenses to be matched with December's revenues would be such things as gas for the delivery van and advertising spots on the radio.

Joe asks Marilyn to provide another example of a cost that wouldn't be paid in December, but would have to be shown/matched as an expense on December's income statement. Marilyn uses the Interest Expense on borrowed money as an example. She asks Joe to assume that on December 1 Direct Delivery borrows $20,000 from Joe's aunt and the company agrees to pay his aunt 6% per year in interest, or $1,200 per year. This interest is to be paid in a lump sum each on December 1 of each year.

Now even though the interest is being paid out to his aunt only once per year as a lump sum, Joe can see that in reality, a little bit of that interest expense is incurred each and every day he's in business. If Joe is preparing monthly income statements, Joe should report one month of Interest Expense on each month's income statement. The amount that Direct Delivery will incur as Interest Expense will be $100 per month all year long ($20,000 x 6% ÷ 12). In other words, Joe needs to match $100 of interest expense with each month's revenues. The interest expense is considered a cost that is necessary to earn the revenues shown on the income statements.

Marilyn explains to Joe that the income statement is a bit more complicated than what she just explained, but for now she just wants Joe to learn some basic accounting concepts and some of the accounting terminology. Marilyn does make sure, however, that Joe understands one simple yet important point: an income statement, does not report the cash coming in—rather, its purpose is to (1) report the revenues earned by the company's efforts during the period, and (2) report the expenses incurred by the company during the same period. The purpose of the income statement is to show a company's profitability during a specific period of time. The difference (or "net") between the revenues and expenses for Direct Delivery is often referred to as the bottom line and it is labeled as either Net Income or Net Loss.

The reporting of profitability involves two things: the amount that was earned (revenues) and the expenses necessary to earn the revenues. As you will see next, the term revenues is not the same as receipts, and the term expenses involves more than just writing a check to pay a bill.

A. Revenues

The main revenues for Direct Delivery are the fees it earns for delivering parcels. Under the accrual basis of acconting (as opposed to the less-preferred cash method of accounting), revenues are recorded when they are earned, not when the company receives the money. Recording revenues when they are earned is the result of one of the basic accounting principles known as the revenue recognition principle.

For example, if Joe delivers 1,000 parcels in December for $4 per delivery, he has technically earned fees totaling $4,000 for that month. He sends invoices to his clients for these fees and his terms require that his clients must pay by January 10. Even though his clients won't be paying Direct Delivery until January 10, the accrual basis of accounting requires that the $4,000 be recorded as December revenues, since that is when the delivery work actually took place. After expenses are matched with these revenues, the income statement for December will show just how profitable the company was in delivering parcels in December.

When Joe receives the $4,000 worth of payment checks from his customers on January 10, he will make an accounting entry to show the money was received. This $4,000 of receipts will not be considered to be January revenues, since the revenues were already reported as revenues in December when they were earned. This $4,000 of receipts will be recorded in January as a reduction in Accounts Receivable. (In December Joe had made an entry to Accounts Receivable and to Sales.)

Now Marilyn turns to the second part of the income statement—expenses. The December income statement should show expenses incurred during December regardless of when the company actually paid for the expenses. For example, if Joe hires someone to help him with December deliveries and Joe agrees to pay him $500 on January 3, that $500 expense needs to be shown on the December income statement. The actual date that the $500 is paid out doesn't matter—what matters is when the work was done—when the expense was incurred—and in this case, the work was done in December. The $500 expense is counted as a December expense even though the money will not be paid out until January 3. The recording of expenses with the related revenues is associated with another basic accounting principle known as the matching principle.

Marilyn explains to Joe that showing the $500 of wages expense on the December income statement will result in a matching of the cost of the labor used to deliver the December parcels with the revenues from delivering the December parcels. This matching principle is very important in measuring just how profitable a company was during a given time period.

Marilyn is delighted to see that Joe already has an intuitive grasp of this basic accounting principle. In order to earn revenues in December, the company had to incur some business expenses in December, even if the expenses won't be paid until January. Other expenses to be matched with December's revenues would be such things as gas for the delivery van and advertising spots on the radio.

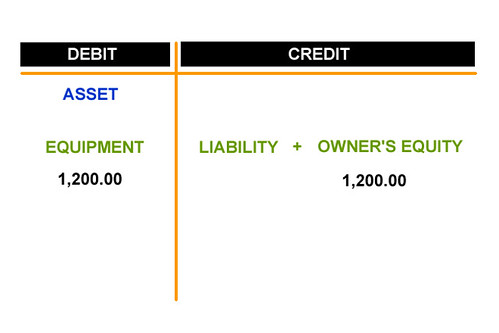

Joe asks Marilyn to provide another example of a cost that wouldn't be paid in December, but would have to be shown/matched as an expense on December's income statement. Marilyn uses the Interest Expense on borrowed money as an example. She asks Joe to assume that on December 1 Direct Delivery borrows $20,000 from Joe's aunt and the company agrees to pay his aunt 6% per year in interest, or $1,200 per year. This interest is to be paid in a lump sum each on December 1 of each year.

Now even though the interest is being paid out to his aunt only once per year as a lump sum, Joe can see that in reality, a little bit of that interest expense is incurred each and every day he's in business. If Joe is preparing monthly income statements, Joe should report one month of Interest Expense on each month's income statement. The amount that Direct Delivery will incur as Interest Expense will be $100 per month all year long ($20,000 x 6% ÷ 12). In other words, Joe needs to match $100 of interest expense with each month's revenues. The interest expense is considered a cost that is necessary to earn the revenues shown on the income statements.

Marilyn explains to Joe that the income statement is a bit more complicated than what she just explained, but for now she just wants Joe to learn some basic accounting concepts and some of the accounting terminology. Marilyn does make sure, however, that Joe understands one simple yet important point: an income statement, does not report the cash coming in—rather, its purpose is to (1) report the revenues earned by the company's efforts during the period, and (2) report the expenses incurred by the company during the same period. The purpose of the income statement is to show a company's profitability during a specific period of time. The difference (or "net") between the revenues and expenses for Direct Delivery is often referred to as the bottom line and it is labeled as either Net Income or Net Loss.